Student loans

Compound interest

Objective

The objective of this activity is to explore the costs associated with attending college and taking out student loans.

Congratulations! You just got accepted into your dream college! However, college can be pretty expensive and the tuition at this school is $25,000 per year. You decide to do some research and apply to financial aid programs to help with these costs.

Funding your first year of college

You just received your financial aid package in the mail and discovered that you will did not receive any scholarships, bummer.

You decide to fully fund your first year of tuition with a Direct unsubsidized federal loan. For this loan, you are charged a 1.057% loan fee along with an interest rate of 4.99% which is compounded monthly.

- Including the loan fee, what is the principal amount of your loan?

- Direct unsubsidized loans start to accrue interest from the date they're disbursed. How much will you owe on this loan at graduation (after 4 years) if no payments have been made?

- After graduation, you decide to start paying off your student loan by making a $300 monthly payment. How long, in years, will it take you to pay off this new balance?

- If you started making $300 monthly payments at the start of college, how long would it take you to pay off your loan?

- How much would you actually spend on your first year of college for each of these options?

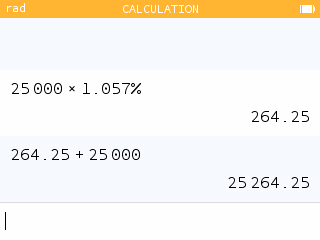

We must first determine the loan fee by multiplying $25,000 by 1.057%. We then add the fee to the original loan amount to determine the principal.

The principal for the loan is $25,264.25.

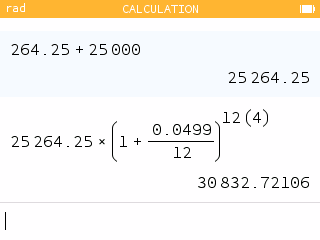

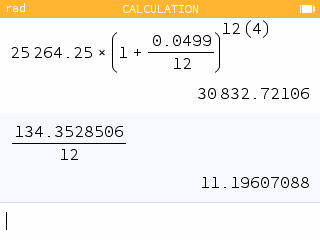

To determine the balance of the loan after 4 years, we use the compound interest formula:

.

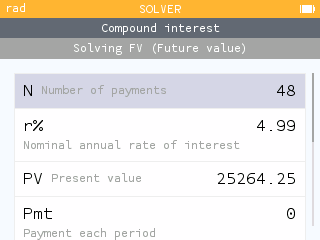

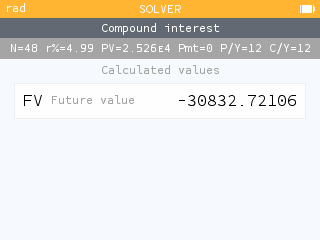

You can also use the Compound interest section of the Finance Solver.

After four years, you will owe $30,832.72.

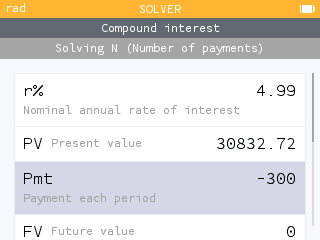

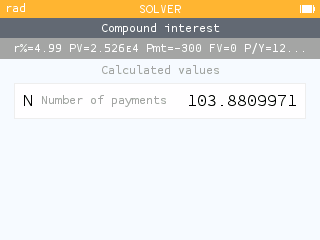

Using the compound interest section of the Finance Solver, we indicate that we are looking for N, the number of payments. We then input our rate (4.99), present value (30,832.72), and payment each period (-300).

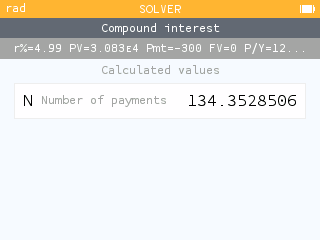

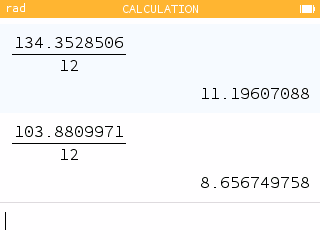

It will take about 134.35 months after graduation to pay off the loan for your first year. Dividing by 12, we can convert this to years.

It will take approximately 11.2 years after graduation to pay off this loan.

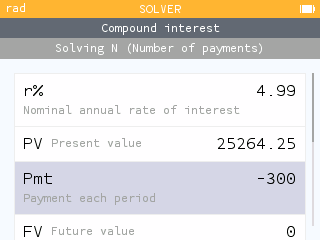

Using the compound interest section of the Finance Solver, we indicate that we are looking for N, the number of payments. We then input our rate (4.99), present value (25,264.25), and payment each period (-300).

It will take about 103.88 months from the start of college to pay off the loan for your first year. Dividing by 12, we can convert this to years.

It will take approximately 8.66 years from the start of college to pay off this loan.

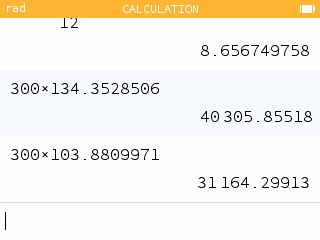

To determine the actual amount spent on the first year of college, multiply the monthly payment ($300) by the number of months it takes to pay off the loan.

By starting to make payments at the start of college, the total cost of the first year will be $31,164.30. If you wait until after graduation to make payments, the first year will cost you $40,305.86.

Scholarships

While the numbers above may be intimidating, there are over 1.7 million scholarships awarded annually. The U.S. Department of Education awards an estimated $46 billion in scholarships annually and private sources award over $7.4 billion in scholarships annually. On average, first time undergraduates who receive government grants and scholarships at a 4-year college receive about $13,690 annually.1

Knowing this, you spent your junior and senior year of high school applying for every scholarship you felt qualified for. Great news! You have now funded 50% of your first year of college through scholarships!

For the remainder of your tuition, you decide to take out a Direct unsubsidized federal loan which charges a 1.057% loan fee along with an interest rate of 4.99% which is compounded monthly.

- Including the loan fee, what is the principal amount of the loan needed to cover half of the tuition for your first year?

- If you started making $300 monthly payments at the start of college, how long would it take you to pay off your loan?

- How does the actual total cost of the first year of college with a scholarship compare to the cost without a scholarship?

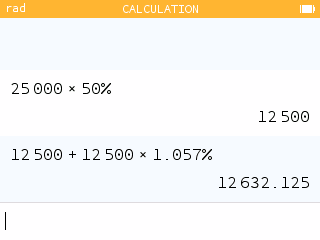

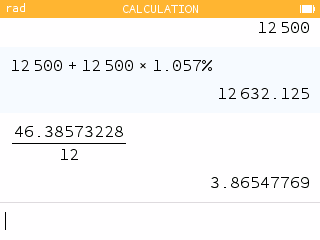

With $12,500 in scholarships, tuition will be $12,500. We must first determine the loan fee by multiplying $12,500 by 1.057%. We then add the fee to the original loan amount to determine the principal.

The principal for the loan is $12,632.13.

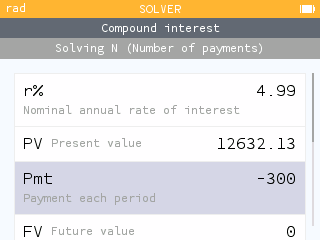

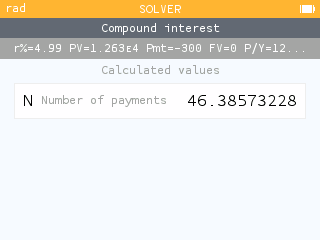

Using the compound interest section of the Finance Solver, we indicate that we are looking for N, the number of payments. We then input our rate (4.99), present value (12,632.13), and payment each period (-300).

It will take about 46.39 months from the start of college to pay off the loan for the first year. Dividing by 12, we can convert this to years.

It will take approximately 3.87 years from the start of college to pay off this loan. That means the first year will be paid off before you graduate!

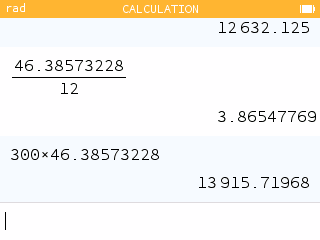

To determine the actual amount spent on the first year of college, multiply the monthly payment ($300) by the number of months it takes to pay off the loan.

With the scholarship and by starting to make payments at the start of college, the total cost of the first year will be $13,915.72. This is $17,248.58 less than without a scholarship! And $26,390.14 less than if you didn't have a scholarship and waited until after college to make payments!

For more information on scholarships and student loans:

- Fastweb, free scholarship search platform that connects students to scholarships and financial aid tools

- US Department of Education: Interest Rates and Fees for Federal Student Loans